It might be true that what happens in Vegas stays in Vegas, but recently what's happening in Los Angeles, Miami, Japan and even on the Food Network is moving into Sin City and the newest batch of hotels along its world-famous Strip.

It might be true that what happens in Vegas stays in Vegas, but recently what's happening in Los Angeles, Miami, Japan and even on the Food Network is moving into Sin City and the newest batch of hotels along its world-famous Strip.

At first blush, a quartet of hotels that have opened on the Strip since April 2013 might seem to echo the hotel-building booms that accompanied previous periods of prosperity in this 150,000-room hotel market, the largest in U.S. But Caesars Entertainment's Nobu Hotel and Cromwell, MGM Resorts International's Delano Las Vegas and SBE Entertainment's SLS Las Vegas mark a departure from traditional Las Vegas accommodations with scales, designs and entertainment offerings that in many ways de-emphasize the gaming element that has forever defined this destination.

With the largest of the four, the SLS, offering "only" 1,613 rooms -- Las Vegas Sands' Venetian tops the Strip hotels at 7,000 rooms, followed by the MGM Grand with 5,000 -- all four properties bring a relative intimacy as well as an approach that attempts to offer a sense of refuge from the chaos of the Strip.

Additionally, these four expand on a trend of Vegas hotels looking to offer an expanding breadth of food, beverage and nightclub outlets that complement -- and at times seem to usurp -- the Strip's long-standing emphasis on casinos and gambling.

That evolving focus reflects a changing market, according to Jeremy Aguero, principal analyst at Applied Analysis, a Las Vegas-based economic research firm.

"There's a demographic shift, and those properties are a significant reflection of that," he said. "You don't see a whole lot of millennials sitting in front of video poker machines."

Among the quartet, the owner of the two hotels with the most central locations along the Strip struck first. Caesars targeted Las Vegas' growing group of food-oriented visitors and opened the Nobu, named for Japanese celebrity chef Nobu Matsuhisa, by carving out a 181-room section of Caesars Palace for the boutique property and opening it to the public last spring.

In May, Caesars reopened what had previously been Bill's Gamblin' Hall as the 188-room Cromwell.

In May, Caesars reopened what had previously been Bill's Gamblin' Hall as the 188-room Cromwell.

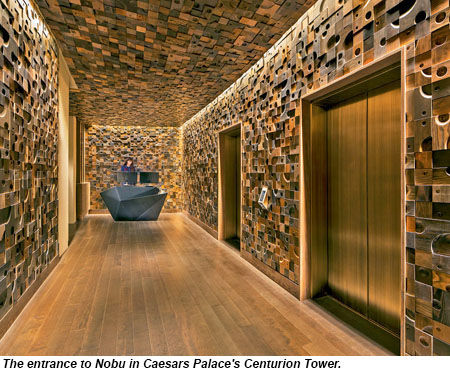

Both hotels' most prominent features mark a substantial departure from the typical Strip property. Nobu's calming, Japanese-inspired motif includes dark woods, decorative Japanese symbols and Asian tea trays in its rooms, not to mention prime access to its namesake restaurant.

The Cromwell takes a decidedly whimsical approach to its room amenities, such as chess sets, vintage pinball machines and humorous, antique-y wall art. While the hotel is tiny by Las Vegas standards, it goes big with its food- and beverage-centric approach by featuring a 10,000-square-foot Italian eatery named for Food Network star Giada De Laurentiis and a 65,000-square-foot Drai's Beach Club pool area/nightclub on the hotel's rooftop.

Guest VIP access to the latter, which is operated by longtime impresario Victor Drai and affords prime views of the Bellagio fountains, is already a draw for potential clients, according to Brian Harris, owner of Aspen, Colo.-based Destination Site Selection. Both the restaurant and nightclub overlook the bustling corner of Las Vegas Boulevard and Flamingo Road.

"With Nobu, it feels like you're somewhere else, even though you're literally in the middle of Caesars," Harris said. "The Cromwell is the [Strip's] only freestanding boutique of 180 rooms. You're not lost. You can get outside in less than five minutes. You don't find that anywhere else in Vegas."

Meanwhile, the SLS and Delano Las Vegas, the two most recently opened properties, are on the fringes of the Strip, which is fitting, given that their owners are banking on brand equity from opposite sides of the continent.

The SLS, which reopened in August at what had been the Sahara from 1952 to 2011, brought a mash-up of some of Los Angeles' most talked-about retail and restaurant brands to the northern end of the Strip.

A sister property to SLS-branded hotels in Los Angeles and South Beach, it is also part of Hilton Worldwide's Curio soft brand, launched earlier this year. The hotel notably includes outposts of L.A.-based restaurants and nightclubs such as Katsuya, Umami, Cleo, the Griddle Cafe, 800 Degrees and the Sayers Club as well as a half-dozen mini-outlets of Southern California-based clothing retailer Fred Segal.

A sister property to SLS-branded hotels in Los Angeles and South Beach, it is also part of Hilton Worldwide's Curio soft brand, launched earlier this year. The hotel notably includes outposts of L.A.-based restaurants and nightclubs such as Katsuya, Umami, Cleo, the Griddle Cafe, 800 Degrees and the Sayers Club as well as a half-dozen mini-outlets of Southern California-based clothing retailer Fred Segal.

Arash Azarbarzin, president of SBE Entertainment's hotel group, estimated that about 40% of the hotel's guests come from the greater Los Angeles area.

"L.A.'s a very finicky market for food and beverage," he said. "We always wanted to bring these proven concepts to Las Vegas. That had been the strategy from day one."

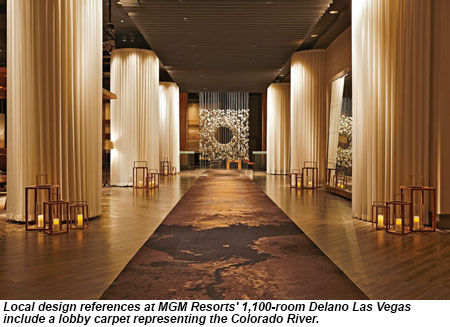

Five miles south, on the opposite end of the Strip, the 1,100-suite Delano Las Vegas opened inside the Mandalay Bay cluster of properties early last month at a site that had operated as TheHotel for the past 11 years.

Starting with a pair of 10-foot-tall Mojave Desert boulders marking the entrance off its underground porte-cochere, the Delano takes a less-bling approach that also places a substantial emphasis on food and beverage operations. MGM Resorts licenses the Delano brand from New York-based boutique hotelier Morgans Hotel Group.

The Delano, which General Manager Matthew Chilton classifies as "refined luxury," includes the daytime American restaurant Della's, the Franklin nightclub (a nod to former President Franklin Delano Roosevelt) and the 3940 Coffee & Tea beverage bar. A restaurant helmed by celebrity chef Alain Ducasse is slated to open in 2015.

Similar to SLS and its sister properties, Chilton says the Delano, unlike the previous hotel in that location, will benefit from the brand equity garnered from outside Las Vegas. Morgans opened the Delano South Beach in 1995, and other Delano properties are slated for Turkey and Colombia.

"Delano is an East Coast brand that we thought would resonate," Chilton said. "It should also resonate with South American and transatlantic visitors."

Both Chilton and SBE Entertainment's Azarbarzin tout their respective hotels' locations at the fringes of the Strip as an attribute, asserting that locals who would otherwise avoid the center of the Strip because of its crowds might be lured to its edges for evening entertainment.

Both Chilton and SBE Entertainment's Azarbarzin tout their respective hotels' locations at the fringes of the Strip as an attribute, asserting that locals who would otherwise avoid the center of the Strip because of its crowds might be lured to its edges for evening entertainment.

"If you're in a car and are trying to go from one location to another on center Strip, you're out of luck," Azarbarzin said. "It can take you 40 minutes to go from the Wynn to the Bellagio."

The SLS is also adjacent to a monorail stop, which Azarbarzin mentioned as a plus. "For us, being on this end and having access off the freeway, it gives us the ability to be easily accessible for the local guest who rarely goes to the Strip during the weekend," he said.

Such new hotels are banking on a continued resurgence in Las Vegas, which attracted a record number of visitors in 2012 and nearly matched that total last year. Through August, the area had boosted its visitor count by 4.1% from a year earlier, to 27.8 million, and was tracking ahead of 2012's record of 39.7 million visitors, according to the Las Vegas Convention & Visitors Authority.

Through August, revenue per available room on the Strip rose 9.3% from a year earlier, and occupancy stood at more than 90%, while room rates were up 6.6%, to about $127 a night.

True to Las Vegas form, the owners of this quartet of hotels bet big on striking a chord with their new concepts, investing a collective $700 million on their 3,100 total rooms, or about $226,000 a room. Betting biggest was SBE Entertainment, which along with money partner Stockbridge Real Estate spent $415 million and three years gutting and updating the old Sahara site in its SLS Las Vegas conversion.

Caesars (then Harrah's Entertainment) acquired what had been the Barbary Coast in 2007 and spent $185 million converting the 188-room Bill's Gamblin' Hall into the Cromwell. Nor was the project accomplished without complications. The site had been earmarked to carry New York's Gansevoort boutique badge until Caesars broke off that licensing deal last year because of issues related to the gaming company's failed effort to get a Massachusetts gaming license. Caesars went with the Cromwell moniker earlier this year.

Fortunately for Caesars, its Nobu "hotel within a hotel" was a more modest affair: It spent about $30 million opening the 181-room property.

Fortunately for Caesars, its Nobu "hotel within a hotel" was a more modest affair: It spent about $30 million opening the 181-room property.

Likewise, MGM Resorts' effort to re-brand TheHotel was simpler than the SLS and Cromwell projects because the property was newer (it opened in 2003) and the site was never fully shut down during the one-year renovation and rebranding process. Even so, the company spent $74 million updating the 1,100-room, all-suites property.

And while all four hotels expect immediate returns on their investments, a greater share of those returns will need to be realized in the form of room rates or food and beverage than in years past, thanks to declining gaming revenue in Las Vegas.

Whereas Strip hotels two decades ago typically derived about 60% of their revenue from gambling, that number today is closer to 35%, according to Aguero. This shift away from gaming is illustrated by recent investments in large-scale projects such as Caesars' $550 million Linq Promenade retail/entertainment district, the first phase of which opened just north of the Cromwell last New Year's Eve, and MGM Resorts' partnership with Anschutz Entertainment Group on a 20,000-seat facility slated to open behind New York-New York in 2016.

The Delano Las Vegas, like its predecessor, doesn't have a casino; guests can explore the gambling areas of Mandalay Bay just outside the Delano's doors.

And while the SLS Las Vegas offers 60,000 square feet of gaming space and even turned part of its Umami burger outlet into a sports book, the hotel doesn't offer high-stakes baccarat, because "we're not into taking that big a risk," Azarbarzin said. He estimated that about a third of SLS Las Vegas' revenue will come from gaming, with another third coming from food and beverage and the rest from room rates.

Granted, that approach isn't without risks. A case in point is the Hard Rock Hotel & Casino, which opened about four blocks off the Strip in 1995 and focused largely on its music scene and rock memorabilia.

Granted, that approach isn't without risks. A case in point is the Hard Rock Hotel & Casino, which opened about four blocks off the Strip in 1995 and focused largely on its music scene and rock memorabilia.

After a couple of expansion projects, however, that hotel couldn't escape the effects of the economic downturn, and by 2011, Morgans Hotel Group was forced to turn the property over to its lender, Brookfield Asset Management.

Moreover, the hotel inventory being added to the Strip presents the danger of diluting guest demand.

Las Vegas room supply had been at a virtual standstill since MGM Resorts and partner Dubai World opened their 5,892-room, three-hotel CityCenter district in 2009. But the Strip will gain another 3,500 rooms in 2017 when Malaysia-based resort operator Genting opens the first phase of its Resorts World Las Vegas project at the old Echelon Resorts site located between the SLS and the central part of the Strip.

Still, the newer hotels' operators say their location along the Strip, combined with rising visitor numbers, more balanced revenue streams and smaller scale, will shield them from the challenges that befell many of Las Vegas' hotels during the last downturn.

Chilton said the Delano is looking to increase its average room rate by about 15% relative to TheHotel, to about $200 a night, making it a more posh alternative to Mandalay Bay's flagship hotel but a more economical choice compared with the Four Seasons property at Mandalay Bay.

Chilton looks to boost spending by the Delano Las Vegas' contingent of convention visitors to as much as 37% of the hotel's revenue, up from the 32% garnered by TheHotel.

SBE Entertainment's Azarbarzin was less specific about targeted occupancy rates or room rates but said he was "very happy with the response" of SLS Las Vegas' guests.

"Even the Marriotts of the world are moving into smaller, more refined, experiential atmospheres," Chilton said. "Las Vegas has gotten out of the recession and is continually reinvesting back into the city. We're happy to be a part of it."

Follow Danny King on Twitter @dktravelweekly.