The hype surrounding the World Cup and Olympics has generated a huge boost in interest in and bookings to Brazil, but concern remains that the country could become a victim of its own success when hordes of people who want to go there can't get a room or can't afford one as demand soars.

The hype surrounding the World Cup and Olympics has generated a huge boost in interest in and bookings to Brazil, but concern remains that the country could become a victim of its own success when hordes of people who want to go there can't get a room or can't afford one as demand soars.

"Brazil has this great platform and this great opportunity between the World Cup and the Olympics, but it's not a given," said Steve Born, senior vice president of marketing at Globus, which has experienced a 24% increase in bookings for Brazil this year across the Globus, Cosmos and Monograms brands compared with the same time last year.

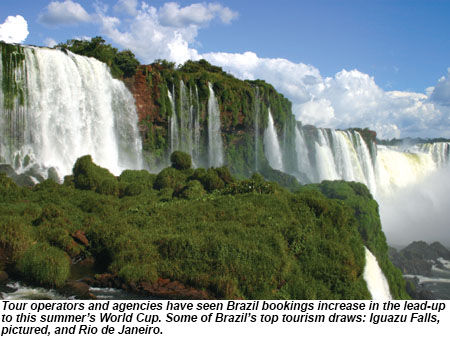

Tour operators and agencies that sell Brazil have experienced a significant increase in bookings in the lead-up to this summer's FIFA World Cup tournament, which will be followed by the 2016 Summer Olympic and Paralympic Games in Rio.

For companies that specialize in sporting events like the World Cup, Brazil is turning out to be one of the top-selling, if not the top-selling, World Cup events for U.S. soccer fans in recent history.

"We're getting more inquiries than we could ever have anticipated," said Nathan Goodson, vice president of marketing for Austin-based Ludus Tours, a company that specializes in selling sports packages. Goodson moved his entire family to Rio seven months ago to better market and sell the destination for the World Cup and the Olympics.

"It's the land of soccer," Goodson said when explaining why so many people are intending to head to Brazil this June and July for the World Cup. He was alluding to Brazil's reputation for being passionate, if not downright fanatical, about futebol. Asked if he thought more U.S. soccer fans would be heading to Brazil than had attended previous World Cup events, Goodson responded, "Yes, I do. I actually do by far. We actually passed those numbers over a year ago."

"It's the land of soccer," Goodson said when explaining why so many people are intending to head to Brazil this June and July for the World Cup. He was alluding to Brazil's reputation for being passionate, if not downright fanatical, about futebol. Asked if he thought more U.S. soccer fans would be heading to Brazil than had attended previous World Cup events, Goodson responded, "Yes, I do. I actually do by far. We actually passed those numbers over a year ago."

Anbritt Stengele, president of Sports Traveler, a Chicago-based tour operator that is selling packages to this year's World Cup and the 2016 Olympics, reported that Brazil is outpacing the company's sales for the World Cup in South Africa in 2010 but has not yet exceeded the number of soccer fans Sports Traveler sent to Germany in 2006.

Nor is it likely that the strong demand will die down for the Brazil Olympics. Ludus Tours already has 150 requests from people preregistering for Olympics packages for 2016.

"I think [the World Cup is] an important test run for them," Stengele said. "They have to get this right in order for people to have confidence to travel there in 2016. I'm sure they're very aware of that."

She added: "The world's going to be watching [the World Cup]. Two years later, the world will be back. We have a tremendous interest level already of people wanting us to plan their trip for 2016. And we're holding back until we see what we learn and what happens."

Double play

Having back-to-back major international sporting events is a marketing coup few countries could ever hope to pull off. But what Brazil does with the increased demand the World Cup and Olympics have already stoked will decide how much travel companies stand to benefit not just before and during the events but after they end, as well.

There are two ways this can play out, Globus' Born observed: Brazil can follow the strategy that China took after the 2008 Beijing Olympics and inflate prices to correspond with an anticipated increase in demand following the tournaments -- "and that really hurt our China business."

Or Brazilian suppliers can embrace the fact that these events serve as a marketing platform, and that in order to convert interest into travel bookings, pricing needs to remain attractive. That was more the approach the U.K. took in the aftermath of the London 2012 Olympics in order to ensure that Britain didn't encounter the post-Olympics slump experienced by past host countries. The U.K.'s strategy has been widely heralded as successful by operators that sell the British destinations.

Or Brazilian suppliers can embrace the fact that these events serve as a marketing platform, and that in order to convert interest into travel bookings, pricing needs to remain attractive. That was more the approach the U.K. took in the aftermath of the London 2012 Olympics in order to ensure that Britain didn't encounter the post-Olympics slump experienced by past host countries. The U.K.'s strategy has been widely heralded as successful by operators that sell the British destinations.

While great for marketing and hype, hosting not just one but two huge international sporting events, one right after the other, poses its own unique challenges.

It could actually overinflate demand for a period of not just one or two years but several years, between now and 2016 or 2017, creating a bit of a Catch-22. On one hand, travelers are much more likely to have their eye on Brazil right now. On the other, once they decide to go, supply and pricing could prohibit them from fulfilling that desire.

"We've had to raise prices more than six times already," noted Ludus Tours' Goodson. Across the board, operators are reporting that pricing in Brazil is going to be one of the biggest challenges before, during and following the World Cup and the Olympics.

"There's a risk of having a two- to three-year period where they take advantage of the events and create pricing that would hurt us," Born said.

For now, operators like Globus are hoping for the best and are building product and capacity to support the inflating interest in Brazil -- and across South America, as travelers look to expand their itineraries beyond Brazil to neighboring countries such as Argentina and Peru.

Practical travel advice

Pricing challenges aside, if travelers want to go to Brazil right now, they can. If they want to go to the World Cup, they can still do that too. And if they want to go to the Olympics, they might as well get started on that, as well.

While supply is dwindling, operators are still selling Brazil for 2014, and specialist sports packagers will likely still be selling the World Cup through late spring.

Operators report that getting to and around Brazil hasn't been an issue yet; international and domestic flights still have available capacity. And FIFA's hospitality division, Match, has apparently been helping operators book the domestic connections they need.

Operators report that getting to and around Brazil hasn't been an issue yet; international and domestic flights still have available capacity. And FIFA's hospitality division, Match, has apparently been helping operators book the domestic connections they need.

But travelers should be prepared to pay a premium as hotel inventory begins drying up in the lead-up to the World Cup. In fact, challenges related to the Olympics will only be exacerbated by the fact that the Olympics will take place primarily in Rio, whereas the World Cup is at least spread out across 12 host cities.

"We're seeing some hotels with 600% or 700% increases," said Brandi Merchant, destination expert for Kensington Tours, which is selling Brazil World Cup packages. "Even people with a really healthy budget, they're saying, 'Wow! that's a lot of money for a five-star.'"

In Rio, demand has shot up in the well-known tourist zones, such as Ipanema and Copacabana. Travelers who might typically opt for four- and five-star accommodations are making do with three-star accommodations so that they can afford to be in those areas, Goodson said, because lowering the quality of their lodgings is still better than being forced to stay in a less desirable or less safe area of the city.

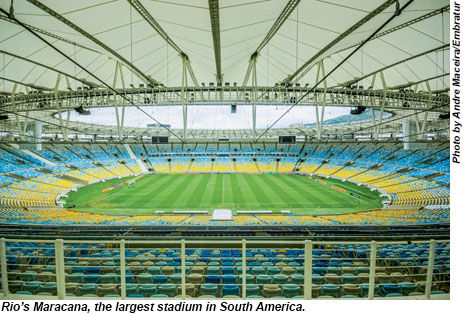

"Just in the beach areas, the more desired safe zone -- Ipanema, Copacabana -- there are at most 28,000 hotel rooms there, and the [Maracana] stadium holds 78,000 people," Goodson said.

The Maracana, the largest stadium in South America (officially called the Estadio Jornalista Mario Filho), reopened in June after a three-year renovation project; its capacity is now 78,838.

The Maracana, the largest stadium in South America (officially called the Estadio Jornalista Mario Filho), reopened in June after a three-year renovation project; its capacity is now 78,838.

"The prices in these two areas, in the dream places, have been skyrocketing," Goodson said. "There's going to be a lot of last-minute bookings, and they're going to end up staying in red zones, areas that are cool to visit but you don't want to stay there."

Safety and security have been a concern for Brazil ever since the country was selected to host both events.

Brazil -- especially Rio -- has a deep-seated, widely recognized problem with poverty and crime. Rio's numerous slums, or favelas, are a very visual component of the city's landscape. And last year, political demonstrations erupted during the Confederations Cup soccer tournament, largely seen as a test run for the World Cup, as citizens used the event's spotlight to voice objections to government spending and other concerns.

Still, operators report that while the media has drawn attention to the uprisings and to security woes, actual travelers appear to be more drawn to the destination's charms than turned off by its challenges.

"I haven't had anyone not book simply because it's in Brazil," Merchant said. "I think if anything, it being in Brazil is making people want to go. I think everybody has heard about what they think the safety is like in Brazil. They do get nervous and they do ask, 'Is it safe?' There are going to be millions of people coming to Brazil."

Concerns about safety as well as the logistical challenges of dealing with droves of people descending on Brazil is what operators are hoping will actually give them a bit of an edge over FIT travel options in being able to provide a certain peace of mind to both leisure travelers and soccer fans getting ready to migrate south.

Concerns about safety as well as the logistical challenges of dealing with droves of people descending on Brazil is what operators are hoping will actually give them a bit of an edge over FIT travel options in being able to provide a certain peace of mind to both leisure travelers and soccer fans getting ready to migrate south.

As for possible political or soccer fan-fueled flare-ups during the World Cup, Goodson said he's not overly concerned.

"There is so much security," Goodson said. Together with his wife, he walked and charted hundreds of miles of Rio to create a "heat map" to help Ludus Tours clients navigate which parts of the city are safe and which less so during their World Cup visit.

"I really am 95% certain that nothing major is going to happen to any of the tourists," he said.

Brazil's moment

The next three years will clearly place Brazil under a spotlight, but with the world's attention focused on the country, it will also find itself under a critical microscope. The intense attention has the potential to highlight the problems Brazil faces as a country, including poverty, crime or infrastructure issues.

But it can also be a force for needed changes and improvements. As Brazil races to prepare for the influx of visitors, improvements to transportation, such as Rio's new Bus Rapid Transit system, could benefit the country's citizens long after the events have concluded.

On the other hand, much of the frustration fueling recent demonstrations has been over the amount of money the government has been investing in event-related infrastructure instead of in much-needed social programs and benefits.

On the other hand, much of the frustration fueling recent demonstrations has been over the amount of money the government has been investing in event-related infrastructure instead of in much-needed social programs and benefits.

While some of the stadiums and venues being built and renovated specifically for the World Cup and the Olympics could bring socioeconomic advantages to local communities, whether and how much of the revenue generated by those venues will be felt on the ground remains a big question mark. So is the issue of whether they will be abandoned and rendered useless once the crowds depart, a la Beijing.

These are among the many issues Brazil is going to have to face internally and with the help of inside and outside investment in light of the massive responsibility these events represent for both the country and the hemisphere.

To measure only by travel sales at this point, Brazil is in good shape.

Companies that bring people to Brazil are already seeing returns from the increased awareness these high-profile competitions garner. They seem confident that overall, Brazil's time in the spotlight will be a net positive for its tourism industry.

"I think that we're going to see in the next five years, everyone will have been to Brazil," said Robin Brooks, Kensington's public relations and marketing manager.

Follow Michelle Baran on Twitter @mbtravelweekly.