It was a year bracketed by disasters.

It was a year bracketed by disasters.

In January, the Costa Concordia, in a series of events that turned out to be as bizarre as they were deadly, passed too close to the Italian island of Giglio and struck a rock that cut a gash in the hull below the waterline, dooming the ship and claiming the lives of 32 passengers and crew.

Nine months later, Sandy, said to be the largest Atlantic hurricane in history, wreaked havoc on the eastern U.S., crippling the New York metropolitan area with flooding and power outages, disrupting travel and causing more than $60 billion in damage, while causing 125 deaths in the U.S. alone.

These were not only shattering events for the travel industry but major disasters that attracted the world's attention. They marked the year and left lasting scars, but they have one thing in common: In time we will be past them. In time they will be memories as distant as the Andrea Doria and Hurricane Hazel.

For now, however, they loom large in our reflections on the year just past and lead our list of the travel industry's major news events of 2012.

Concordia

The Concordia was in every way a man-made disaster; in fact, some would lay all the blame on one man, Capt. Francesco Schettino, whose exploits made him the media goat and an object of derision, even when the official inquiries had barely begun.

In today's digital world, with instant communications, social media networks and ubiquitous smartphones, revelations about the events of Jan. 13 came fast and furious, and from every direction.

Perhaps the low point came with the release of the audio recording of the conversation between Schettino and the local harbor master, who exhorted the captain to get out of his lifeboat and "get back onboard" to coordinate the rescue of the remaining passengers.

Perhaps the low point came with the release of the audio recording of the conversation between Schettino and the local harbor master, who exhorted the captain to get out of his lifeboat and "get back onboard" to coordinate the rescue of the remaining passengers.

Complete with its Italian expletive, the phrase "Vada a bordo, cazzo" began showing up on T-shirts within hours.

Put bluntly, the whole affair reflected badly on cruising and on Costa and led some pundits to wonder if the Costa brand could survive. But no such doubts were ever uttered from the headquarters of parent company Carnival Corp., whose chairman, Micky Arison, said in a Travel Weekly interview, "We will get over this. It may take a year or two, and if it does we'll stick with it."

It was recognized early on that whatever human errors led to this disaster, the industry would have to learn from them and regain the trust of inquiring regulators and an anxious public. Reacting swiftly, CLIA organized a Cruise Industry Operational Safety Review, and its first accomplishment was a voluntary industry commitment to require all passengers to participate in a muster drill prior to departure from port.

Other reforms governing bridge procedures, the content of emergency instructions to passengers, crew training, the availability of additional life jackets and other topics have also been adopted.

A year ago, the cruise industry had been looking at 2012 as a year of continued recovery as the global economy improved. That remains the posture for 2013, but there are already signs that the economic ripple effects of the Concordia disaster are receding.

Although yields have not recovered, Carnival Corp. reports that bookings are strong for its other brands, and the industry's Big Three are again shopping for new tonnage. Carnival Corp. in October ordered two new ships for its Holland America and Carnival brands for delivery in 2015 and 2016, respectively. Norwegian Cruise Line, which is planning to deploy the new Breakaway and Getaway in 2013 and 2014, placed an order for a 163,000-gross-ton "Breakaway Plus" for delivery in 2015.

Royal Caribbean, meanwhile, acknowledged that it is in talks about construction of a third Oasis-class ship for delivery in 2016.

The future is once again on the way.

The perfect storm

All the numbers pinned to Superstorm Sandy are big, as befitting a storm whose size left a trail of death and destruction from Puerto Rico to Quebec during the last days of October.

Though the damage to the Caribbean's fragile tourism infrastructure was not as great as some other recent hurricanes, the overall economic impact on travel, and on the media, was magnified because the storm made a direct hit on the most densely populated areas of the country, including one of our biggest travel markets and destinations: New York.

How much of the storm's $60 billion in damages will be chalked up to travel is difficult to say. The airline industry could be looking at an all-in loss of up to $300 million, according to analyst Michael Boyd. US Airways alone is expected to suffer a Q4 earnings loss of $35 million, and other carriers issued guidance about losses of similar magnitude. Overall, an estimated 20,000 U.S. airline flights were canceled as a result of the storm.

In addition to closing numerous airports up and down the East Coast, the storm shuttered New York's main airports and cruise ports, flooded lower Manhattan, inundated subway and Amtrak tunnels, wiped out portions of commuter train lines and left vast areas of the region without power for days, disrupting thousands of hospitality and travel-related businesses.

Flood damage also led to a shortage of rental cars in the region, causing the industry's largest player, Enterprise Holdings, to relocate more than 12,000 vehicles to the New York metro area, according to Auto Rental News.

Most businesses and key attractions eventually reopened. Atlantic City's boardwalk is back in action, as is the 9/11 Memorial in lower Manhattan, but Liberty Island, home to the Statue of Liberty, will remain closed indefinitely due to flood damage.

One bright note, a lesson for all contingency planners, was that the task of accommodating and rebooking clients in the midst of floods and prolonged power outages was made easier by the widespread deployment of smartphones, iPads and similar mobile devices.

Some agents learned the hard way that it is possible for a few days to run a businesses on an iPhone and car charger.

R-E-S-P-E-C-T

One of the long-running jokes at the U.S. Travel Association has been that the travel industry is the Rodney Dangerfield of the Washington power game, because it gets no respect. It's a joke that might have to be retired, because the travel industry is finally getting some respect from a government concerned about exports, employment and economic development.

One of the biggest changes in attitude was institutionalized in the U.S. in the Travel Promotion Act, which was signed into law in 2010 and gave birth the following year to the Corporation for Travel Promotion, or Brand USA, charged with promoting the U.S. as a travel destination in overseas markets.

In 2012, the Obama administration followed up on this initiative with a policy statement acknowledging what the industry has been trying to tell the government for years, that "the travel and tourism industry is one of our nation's leading service sectors and sources of exports."

In 2012, the Obama administration followed up on this initiative with a policy statement acknowledging what the industry has been trying to tell the government for years, that "the travel and tourism industry is one of our nation's leading service sectors and sources of exports."

At a much-publicized appearance at Disney World in January, President Obama announced an executive order that set in motion the development of a "National Travel and Tourism Strategy," something we didn't have before. The president also committed his administration to the goal, long advocated by the industry, of reducing visa processing times in China, Brazil, India and other countries where paperwork and delays had become a deterrent to travel.

Four months after the executive order, a task force comprising eight government agencies had drafted a strategy with the principal goal of increasing U.S. international arrivals to 100 million a year by 2021.

The strategy also call for "support for travel and tourism across the federal government."

And it appears to be more than election-year rhetoric. In a mid-September progress report, the administration noted that visa wait times in Sao Paulo, Brazil, had been reduced from four months to two days, in the face of a 37% increase in demand.

This was far more attention than travel and tourism had come to expect from the federal government, but the respect story doesn't end there. In June, tourism ministers from the world's largest economies, the Group of 20, succeeded in getting their governments to include a statement on travel and tourism in the annual declaration after their 2012 Summit in Los Cabos.

It states, for the first time, that the G-20 nations "recognize the role of travel and tourism as a vehicle for job creation, economic growth and development" and "will work towards developing travel facilitation initiatives."

Adios, Rodney.

Reinventing ARC

The Fractured History of Travel would have you believe that shortly after the Wright Brothers invented air travel, they invented ways to pick fights with travel agents, some of which live on in ARC's Agent Reporting Agreement and Industry Agents' Handbook.

Clearly, the history of the relationship between travel agents and ARC and its predecessor has been punctuated, if not dominated, by confrontation. But a group of determined reformers representing airlines and travel agents managed to rewrite some of that history in 2012 with the first major revision to the underlying contract that has governed agents' dealings with ARC since 1985.

It appears to have been a genuine case of "give-and-take."

The airlines wanted some risk reduction in the form of a shorter cash remittance cycle or higher agency bonds, and as a result the 10-day remitting cycle will be cut to five when the agreement is fully implemented on July 1. But in return, agents get faster processing of client fees, which turns out to be a net benefit for many agents.

In addition to a complete rerendering of the documents in a user-friendly style, the contract revision created a new "associate branch" category that takes some of the sting out of a current restriction that a branch office must be wholly owned by its parent agency. Under the new language, two or more entities will be permitted to share ownership of a branch office.

Agents will also have the flexibility to use two or more ARC numbers at the same location or keep the same number when moving to a different state.

Although the rewrite is not all sweetness and light for agents, the balance of benefits is considerably more equitable than some agents might have expected from the ARC of old. The prospect of a "kinder, gentler ARC" was something of a gag line when it first surfaced a few years ago, but by all accounts the 2012 rewrite was focused on practicalities. In a business relationship that still has some legacy baggage, there might be no better place to seek common ground.

Reinventing ASTA

ASTA entered 2012 with its share of problems, among them a continuing decline in membership and a related and ongoing challenge of remaining relevant to a changing agency population. It's going to end the year with the same problems, but with solutions in place that could make a difference in 2013 and beyond.

Launching a membership drive in May, then-president Tony Gonchar said that only 20% to 25% of agents were dues-paying members. At that level, he said, there was some question about whether ASTA could continue doing what it does.

In the end, the membership drive resulted in only a marginal increase in the numbers, leading to an even more radical solution that was unveiled last month: a new membership and dues structure that will base the annual dues on the size of the agency and that will recognize all employees at an ASTA agency as members.

Gone is the flat fee of $277 for annual dues. In its place is a sliding scale ranging from $295 for agencies with volume of $5 million or less to $2,500 for agencies with volume of $50 million or more.

But the dues structure won't be the only thing giving ASTA a new look. The Society also broke from its historic geographical focus to recognize its Young Professionals Society as a chapter in its own right, the first chapter in ASTA's history to represent a community of agents whose unifying trait is not their address but a demographic attribute.

That could be a peek into ASTA's future in more ways than one.

In conjunction with the National Tour Association, ASTA also sponsored a Hispanics in Travel Caucus at its Travel Retailing and Destination Expo in Los Angeles in a related effort to broaden its appeal.

Another encouraging sign for ASTA in 2012 was the election of three Travel Leaders executives to at-large seats on the ASTA Board. The three -- Roger Block, Travel Leaders Franchise Group; Jackie Friedman, Nexion; and John Lovell, Vacation.com -- entered the race to demonstrate their support for ASTA and its advocacy role.

If these initiatives gain traction, ASTA could look back on 2012 as a turnaround year.

Ancillary angst

The travel industry's Never Ending Story did not come to an end in 2012, but the debate over ancillary fees reached a new plateau this year.

Various airlines and GDSs have proven that it is possible to display ancillary services in GDSs in a manner that makes them bookable by travel agents. US Airways' Choice Seats are in Sabre, which also has a full-content deal with Air France-KLM. Delta's Economy Comfort product is in Travelport, as are various Qantas ancillaries. Amadeus has agreements for ancillaries with airlines all over Europe.

In short, it can be done. In the U.S., however, the pace of progress has been glacial, a term that might also describe the cool negotiating climate between and among airlines, agents and the GDSs. The negotiating climate is further clouded by the prospect of new approaches to the query and search process, whereby airlines would display information based on the identity and preferences of the user.

In short, it can be done. In the U.S., however, the pace of progress has been glacial, a term that might also describe the cool negotiating climate between and among airlines, agents and the GDSs. The negotiating climate is further clouded by the prospect of new approaches to the query and search process, whereby airlines would display information based on the identity and preferences of the user.

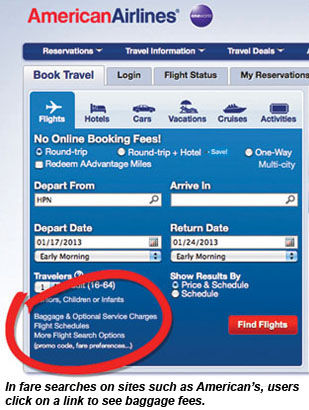

For now, however, agents want the ancillaries in the GDS, as do their corporate clients. The GDSs want to deliver them. The airlines say they know it's in their best interests to make these revenue-producing products widely available. And yet most agents seeking to book ancillaries such as preferred seating or checked baggage must cope with time-consuming workarounds.

Something has to give, and some say it's the government. ASTA and others say the Transportation Department (DOT) must force the issue and order the airlines to make these services available in all their sales channels, in the name of simple fairness and transparency.

But a consumer advisory committee empaneled by the DOT did not come to the same conclusion and, while endorsing transparency, refrained from recommending that the DOT step in.

According to some airline people, the mere threat of a DOT mandate is interfering with the marketplace because GDSs are reluctant to make concessions if there is a chance that the DOT will force the airlines to the table.

That's where we were in January, and that's where we are now. For those seeking a breakthrough in this stalemate, 2012 was a long year.

Consolidation

The travel industry's hardy perennials, mergers and acquisitions, sprouted some new deals in 2012, and while the giant of the species, the Airline Merger, didn't bloom in the U.S., British Airways' parent, International Airlines Group, concluded the absorption of its longtime domestic rival BMI.

That deal, in turn, helped trigger Delta's decision to acquire Singapore's 49% stake in Virgin Atlantic with an eye toward a joint venture that would help both carriers in the BA-dominated Heathrow market.

(Flower lovers should note that there's a definite bud in the American bankruptcy reorganization, which may involve a combination with US Airways.)

Outside of the airline realm, the biggest supplier deal to go down in 2012 was the Hertz acquisition of Dollar Thrifty, a $2.3 billion transaction that capped two years of on-and-off negotiations and posturing, including a bidding war with Avis Budget in 2011.

Although no brand names will be going away as a result of the deal, it brings one more supplier segment into a Big Three scenario where the lion's share of the business is shared by three major players: in this case, Enterprise, Hertz and Avis Budget.

In lodging, Marriott acquired the Gaylord Hotels brand from Gaylord Entertainment, which maintains ownership of its properties and meeting venues as a real estate investment trust, renamed Ryman Hospitality Properties.

Elsewhere in travel there were a host of deals involving technology, distribution and search.

The surprise of the year might have been Priceline's agreement to acquire Kayak for $1.8 billion just a few months after Kayak went public. That price tag represents a 29% premium over the prevailing stock price and sent the blogosphere buzzing about growth, synergy, offense, defense, mobile platforms and the future of metasearch.

Google acquired the venerable Frommer's guidebook brand, and Sabre absorbed the Prism Group's consulting and corporate data management business.

Among wholesale operators, Funjet acquired Boston's TNT Vacations, and New Jersey's Central Holidays was acquired by Egyptian travel company Sakkara Group, which owns tour operators STI Travel USA and its counterparts in the U.K., India and France.

Retailers also got into the act, and New York agencies were particularly active in M&A this year. Travel Leaders' Tzell Travel acquired Protravel; Ultramar merged with Omaha-based Travel and Transport and Altour acquired Road Concierge.

Destinations in distress

Violence and political unrest remained in the headlines for several key destinations in 2012, keeping travelers away, sometimes in droves.

To varying degrees, consumer perceptions of Mexico, Egypt and Israel were colored this year by headlines and government travel advisories.

Even Greece felt the pinch from the effect of persistent strikes and demonstrations over its economic woes, prompting the Greek National Tourism Organization to launch a midyear campaign calling attention to the "True Greece."

Mexico entered the year on a high note, having posted a record year in tourist arrivals in 2011. But it did so in the face of a decline in arrivals from the U.S., its largest market and the market where it continued to wrestle with image problems.

News reports of drug-related violence in Mexico this year were considerably muted compared with some previous years, and the U.S. State Department did not find it necessary to issue dire warnings. But there were occasional problems, such as a highly publicized and somewhat odd "travel warning" from the Texas Department of Public Safety, which for the third year in a row advised travelers to avoid Mexico entirely for spring break travel.

News reports of drug-related violence in Mexico this year were considerably muted compared with some previous years, and the U.S. State Department did not find it necessary to issue dire warnings. But there were occasional problems, such as a highly publicized and somewhat odd "travel warning" from the Texas Department of Public Safety, which for the third year in a row advised travelers to avoid Mexico entirely for spring break travel.

Undeterred, Mexico's tourism industry continues to develop and expand.

In the Middle East, however, the news was mixed and mostly bad.

The hostilities in Syria, standing alone, might have been enough to dampen interest in the entire region, but it didn't end there. Israel, which reported a decline in U.S. visitors in 2011, endured sporadic mortar and rocket attacks from Gaza throughout the year until an escalation in November led to a negotiated cease-fire.

Egyptian President Mohamed Morsi gained some stature on the world stage for his role in brokering the cease-fire, but the glow was short-lived. Within days the Egyptian president issued a decree granting himself broad new powers, triggering yet another round of violent protests in the streets of Cairo. He later rescinded the decree, but uncertainty remains and a return to Tourism as Usual awaits another day.

River dance

Rivers were humanity's first highways, and one of travel's greatest success stories in 2012 has been the ongoing rediscovery of the "old roads."

There might be no better symbol of the industry's explosive growth than the recent experience of Viking River Cruises. Not only did the line launch six ships this year, but it recently placed an order for another 10, bringing its delivery schedule to 10 ships in 2013, followed by another eight in 2014 and options for several more through 2017.

If you can think of another company that has ever added 24 newbuilds to a river fleet in the space of three years, pencil in the name here: ____.

If you can think of another company that has ever added 24 newbuilds to a river fleet in the space of three years, pencil in the name here: ____.

According to CLIA's Cruise Industry Update released in February, the river cruise segment has been heartily outpacing the growth of deep-water cruising, experiencing an annual 10% growth in passengers and a correspondingly rapid growth in new ships.

A midyear survey of CLIA-member travel agents showed that this category of cruising was becoming an important component of agency business, as a clear majority of agents described it as "a growing sales opportunity," which is probably an understatement.

The trends might have even helped to spark the rebirth of competitive Mississippi river cruising, once dormant, with the relaunch of the 436-passenger American Queen and the introduction of American Cruise Lines' 150-passenger newbuild the Queen of the Mississippi.

All over the world, operators are continuing to innovate with ship designs and itineraries. Not only were balconies on river ships unheard of just a few years ago, so were cruises on the Chobe River in Botswana and the Irrawaddy River in Myanmar.

A sure sign that the industry had arrived at a tipping point was the integration of the Specialty Cruise Collection, an association of river and small-ship lines, into CLIA. Welcome to the club.

The mobile breakout

When something doubles, people notice. Not many things in travel doubled in 2012, but one thing clearly did: the dollar volume of travel bookings on mobile devices such as smartphones and tablet computers.

PhoCusWright puts the figure at $6.7 billion and projects it will approach $23 billion in 2014 and account for 16% of the online travel market.

The numbers likely reflect the confluence of two trends. First, ownership of mobile devices is rising. By 2015, 90% of U.S. leisure travelers will own a smartphone, up from 54% this year, according to Atmosphere Research. Second, the ease of use and easy availability of an exploding galaxy of apps means that mobile devices are increasingly being used for a broadening variety of tasks.

Kayak, the metasearch site, reported this year that its mobile app had been downloaded 20 million times. Clearly, people are searching and shopping even when they're on the go.

Matching a move by Priceline from last year, Expedia this summer launched a mobile-only promotion offering exclusive discounts to users of its mobile app. Research had shown that about 70% of hotel rooms booked via mobile device were for room stays within 24 hours of the booking.

Smartphone users are not merely using tiny handheld computers, they're multitasking and looking for quick answers. Mobile means now.

Mobile computing, coupled with the growth and power of social media, is also changing the way travel companies think about their products.

Royal Caribbean this year made a commitment to bring upgraded broadband WiFi to its ships, partly to appeal to the always-on generation but also to exploit the added immediacy that mobile apps give to the viral marketing potential of social media.

In the past few years, the world has learned that if an experience can be shared through Twitter and Facebook, it will be.

An additional lesson for marketers in 2012 might be that "I was there" is not quite the same as "I am here."